Watch Now

Watch Now

Too Big to Fail (2011)

Watch Now

Watch Now

An intimate look at the epochal financial crisis of 2008 and the powerful men and women who decided the fate of the world's economy in a matter of a few weeks.

Watch Trailer

Cast

Similar titles

Reviews

Absolutely the worst movie.

By the time the dramatic fireworks start popping off, each one feels earned.

The film never slows down or bores, plunging from one harrowing sequence to the next.

An old-fashioned movie made with new-fashioned finesse.

If you intend to watch this movie for entertainment purposes - probably you can pick something better than financial meltdown, however if you intend to watch this movie for the purpose of better insight on what really happened - you should skip it and look further.. poor attempt to create superman heroes out of paulson, bernanke and entire banking safeguard crowd. During the movie, i honestly didn't know if i should laugh or cry ..it is honestly sad and tragedy if they sell this material to anyone on this planet as a story of what truly happened. there is a good reason why banking industry calls equity stocks "stock markets retard brother" .. money market is where the money rolls and everyone in the chain is holding the ladder and full control is in place. I am not one of these conspiracy theories type, this has nothing to do with conspiracy - just corruption beyond possibility to comprehend..and turns - sadly out, that even HBO is holding the ladder... Paulson doesn't even has to bother one day to write himself a beautiful perky biography, script of this movies will do just fine ..as if he wrote it..

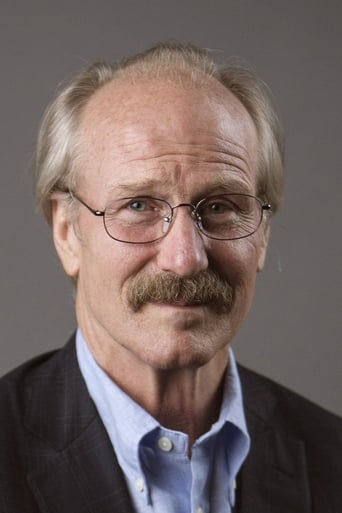

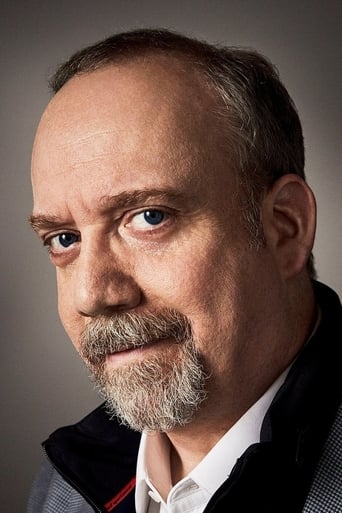

'Too Big to Fail' talks about the 2008 financial meltdown, it gets into the roots & speaks the language of Wall Street. It's A Masterstroke of a film, because its compelling & shocking. Its a razor-sharp, no-holds-barred film, that works in every level.'Too Big to Fail' Chronicles the financial meltdown of 2008 and centers on Treasury Secretary Henry Paulson.'Too Big to Fail' is compelling & shocking. Peter Gould's Adapted Screenplay is gut-wrenching. Its so detailed & accurate, that it keeps surprising you. Curtis Hanson's Direction is top-notch. Cinematography & Editing are crisp.Performance-Wise: James Woods as Dick Fuld, is terrific. Like always, the mesmerizing actor sinks his teeth into the part & performs fearlessly. William Hurt as Henry Paulson, is remarkable, yet again. Paul Giamatti as Ben Bernanke, is masterful. Billy Crudup as Timothy Geithner, is flawless & this performance ranks amongst his finest to date. Bill Pullman as Jamie Dimon & Tony Shalhoub as John Mack, are quite good. Topher Grace as Jim Wilkinson, plays his part like a pro. Cynthia Nixon as Michele Davis, deserves a special mention.On the whole, 'Too Big to Fail' is a Big Winner.

Unfortunately the filmmakers felt the need to create a "hero" of the piece -- unlike the source book, which simply tells what happened. They chose Henry Paulson (William Hurt), ex-Goldman Sachs CEO turned Treasury Secretary. But the real-life Paulson is no hero.The film makes a point that Paulson sold all his Goldman stock before becoming Treasury Sec, but fails to point out that he was excused from all taxes on the sale, which saved him upwards of $50 million.The film also whitewashes Paulson's $150 billion AIG bailout, claiming that AIG owed money to almost everybody in the world. In fact, AIG's largest creditor was, that's right, Goldman Sachs. Paulson failed to negotiate a hard-nosed payout of AIG's obligations, such as offering creditors 50c on the dollar, which the creditors would have had no choice but to accept. This would have saved US taxpayers a cool $75 billion. But it would have hurt Paulson's pals at Goldman.My point being, Paulson was thoroughly compromised, and managed to feather his own nest and that of his old pals. What next? A stirring depiction of Dick Cheney's altruistic hiring of Halliburton in Iraq? This shortcoming aside, the film clips along nicely, and it's fun to see so many name actors portraying the Wall Street titans. James Woods is a perfect Dick Fuld.

As a financial adviser, I have two very different thoughts on "Too Big to Fail".First, I was fascinated by the human element - the relationships between decision-makers, the communication, the uncertainty, the failings and doubts we all possess. We all read the headlines, but rarely are we given even the slightest insight about the decision-making processes that affect us all.Second, and unfortunately, the story is told with such obvious omissions and distortions that it is clear writer Andrew Ross Sorkin not only carries a partisan grudge, but made little attempt to hide that grudge in the script. Just a few examples of many: 1. One clear "villain" of the meltdown was the American consumer - those who willingly purchased homes they quite well knew they couldn't afford, took advantage of 125% refi's to pay off credit cards so that they could run them up again, tapped into their equity for trips, cars, boats and other goodies, etc. Instead, they were clearly portrayed as victims, and the only time a reference is made to them is when the biggest villain in the film, Dick Fuld, is scoffing at them.2. Legislators Barney Frank and Chris Dodd, who are documented to have made errors in judgment leading up to the crisis, are portrayed as having absolutely nothing to do with it, completely stunned that this was happening - worse, they come off as passionate defenders of the people. Only someone who knows absolutely nothing of this crisis would fall for this. Come on, Mr. Sorkin.3. Then-SEC Chairman Christopher Cox, the highest-profile Republican in the story, is portrayed as a bumbling, indecisive, oafish fool. If the rest of the film were not so left-leaning, this portrayal may not have been so obvious. Instead, it falls right in line with the rest of the partisan approach.4. When assistant Michele Davis asks why regulators failed to notice and act upon the blatant problems in the mortgage industry, Hank Paulson sheepishly responds, "because we were making too much money." What?! The federal government failed to do its job because some people were making a lot of money? Wouldn't an indictment of such magnitude warrant a much larger inspection during this movie? Instead, it's just passed off as "greed". Astonishing.5. Blame for the entire economic meltdown is placed in one place, and one place only: Those Evil Banks. Not one ounce of blame (outside of the ridiculous statement in #4, above) is placed on the massive failure of regulators to do their job; on the consumers who willingly signed on the dotted line, on the bureaucrats from both parties who pushed Fannie Mae and Freddie Mac to make bad loans in the interest of "fairness." I could go on. In short, partisan politics (from BOTH sides) have so polluted our everyday culture that it's now impossible to believe anything you hear, read or see. "Too Big To Fail" is a vivid example.Here's the problem: This film had a chance to teach us critical lessons about the financial meltdown. An accurate approach could have served as a road map for the future, a warning siren to everyone from politicians to Wall Streeters to regular citizens on the dangers of personal greed, of poor political leadership and of the need for more effective regulation of financial markets.Instead, it's just another political statement disguised as "fact". What a shame..